What is the New Active Management?

Our New active Approach is an active investment management, free of the allocation constraints imposed by benchmarks and focused on investing by strategy, not by asset class

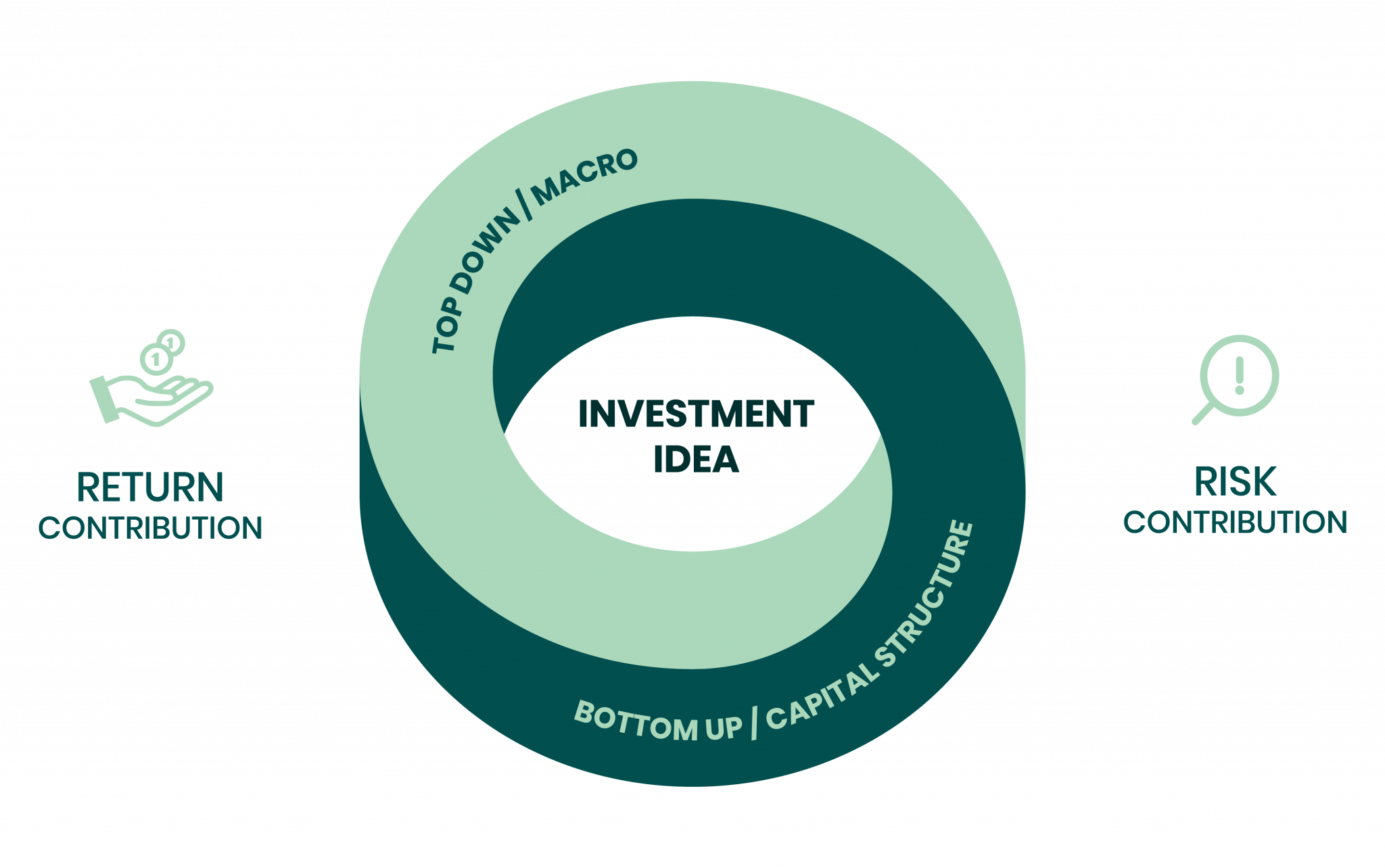

By selecting the best opportunities that emerge from time to time during market cycles and integrating the different expertise of our team, we use this approach to globally select individual opportunities to achieve the fund's return and risk objective.

Designed to build a stable source of carry for the portfolio, through investment in cash flow generating assets (equities, credit, real estate).

High quality companies that can grow and compound earnings over several years. Internal ownership, strong balance sheets, high and stable Return on Invested Capital.

Equity markets, rates, currencies, countries and sectors, with individual positions which reflect our view of the world through the economic cycle.

Assets where catalysts and circumstances (M&A, distressed assets, etc.) are very company specific. Such assets provide bottom-up, uncorrelated investments.

Asset which are less correlated with the rest of the portfolio, and that work in periods of market disruption (gold, real assets, volatility and commodities).

Plenisfer Investments SGR S.p.A.

Via Niccolò Machiavelli 4

34132 Trieste (TS)

Via Sant'Andrea 10/A, 20121 Milano (MI)

info@plenisfer.com

+39 02 0064 4000

Contact us at info@plenisfer.com

This is a marketing communication. Please refer to the Prospectus and Key Investor Information Document (KIID/KID) before making any final investment decisions. Past performance is no indication of future performance. Past performance is no indication of future performance.

The value of your investment and the return on it can go down as well as up and, on redemption, you may receive less than you originally invested.

© Copyright Plenisfer Investments onwards 2020. Designed by Creative Bulls. All rights reserved.